Reset Your Financial Life

Practice Areas

Bankruptcy

Stop Foreclosure

Repossession

Debt Happens – But It Doesn’t Have To Ruin Your Life

Debt is an important aspect of our economy. It is how most people can purchase a home and a car or start a business. Unfortunately, debt can make life extremely stressful when circumstances leave a person with more debt than they can manage.

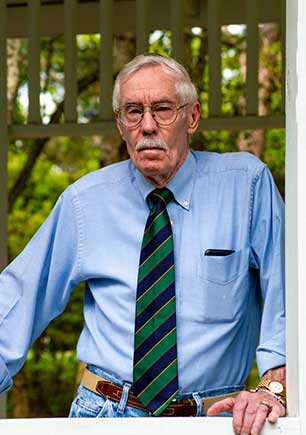

Bankruptcy allows people to reset their financial life and eliminate the stress of debt that they will not otherwise be able to erase. Bankruptcy is often misconstrued as negative, when in fact, it is something more people should turn to sooner to resolve their debt problems. At David A. Himes & Associates, PLLC, we help individuals get a fresh financial start through Chapter 7 or Chapter 13 bankruptcy.

Choose The Solution That’s Right For You

In Chapter 7 bankruptcy, an individual or a couple can eliminate much of their unsecured debt, including credit card debt, medical bills and unsecured personal loans. It is important to understand that you can keep many of your possessions in a Chapter 7 bankruptcy, such as your car, computer, personal items and possibly even your house.

In Chapter 13 bankruptcy, a person restructures their debt and creates a repayment plan. The debtor typically pays a percentage of what is owed over a three- to five-year period. Chapter 13 bankruptcy usually allows a person to stay in their home and retain most of their possessions.

We can review your situation and recommend the solution that is best for you.

Start Eliminating Your Debt Today

Too many people make the mistake of letting unmanageable debt linger. The best step is to review your options with our experienced bankruptcy attorney as soon as possible so you can get back to living the life you deserve. Our services include a detailed plan on how to rebuild your credit.

Call 936-310-2990 or use our online contact form to schedule a free phone consultation. We will answer your questions and recommend a course of action.

Stay In Your Home

Texas law provides protections for homeowners who are struggling to make their mortgage payment. We may be able to help you negotiate a realistic payment plan with your bank. It’s a good idea to consult a lawyer if the bank is trying to foreclose on your home.